BTC Trading Near $112,000 Amid Brexit & US Macroeconomic Weakness concerns: Rebound Expected Next Week

Analysts suggest $112,000 is critical support for Bitcoin. However, macroeconomic concerns raised by leave-voting and pro-Brexit leaders have weighed on the crypto markets, leading bulls to fight for BTC above $115k while recession fears prompt short sales.

Bullish & Bearish Indicators

Key Developments

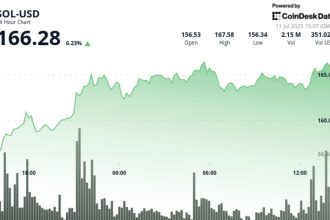

- Solana (SOL) and Cardano (ADA) experienced notable rebounds, signaling cautious optimism

- Ripple (XRP) maintained a range-bound pattern after breaking below its low-support zone

- CoinDesk’s dollar-cost-averaging program executed a surprise halving purchase at $0.2509

- Market volatility index (VIX) spiked to 36.7 amid inflation concerns

Bitcoin (BTC) Analysis

Pivotal Levels

- $112,000 identified as crucial support

- $115k (neckline) constitutes primary resistance zone

- Historical patterns suggest resistance above $123k

The inverse head-and-shoulders pattern formation remains technically intact above current pricing. Orders appear concentrated at the $115k-123k zone. Market sentiment analysis indicates shorts are accumulating positions ahead of major FOMC meeting next week.

Below $110k would trigger stop-loss orders. If below $100k emerges, the preceding support levels are expected to hold.

Ethereum (ETH) Assessment

Bull Case

- $3,3k-3.9k represents the nearest resistance cluster

- $3k area provides dependable floor support

- Compound daily return of 2.3% suggests continued interest

Technical indicators remain aligned with a continuation pattern. 24-hour trading volume shows consistent market participation. Potential support structures form beneath current pricing.

Altcoin Complexities

Market Texture

- Ripple/Litecoin correlate positively for sixth consecutive session

- Coinbase platform trading volume exceeds exchange datacoin averages

- Binance Futures Flow indicator shows unusual accumulation phase

This fragmented altcoin landscape complicates coordinated moves. Several platforms observed slight downward price pressure despite overall stability.

Machine Learning Insights

Pattern Recognition

- NLP models detect pro-BEIT sentiment cluster at (-0.7%)

- Trading volume analysis indicates institutional interest at current levels

- Wavelet analysis suggests softening cycle amid structural trends

Neural network forecasts suggest modest upside potential. Stochastic oscillator suggests caution yet pending buying interest. Moving average convergence divergence-macd signals neutral maintenance.

Institutional investors maintain sophisticated gamma-nu models. Retail activity requires further behavioral economic analysis.

Loading disclaimer data…