HODLing Payoffs: Crypto Buyers Cling to Wins, Potential Breakout on Deck

Bitcoin and most altcoins are trading within tight ranges, suggesting buying exhaustion or indecision, according to recent analyses. However, persistent buying pressure on some coins signals a readiness to pounce should the market rekindle. Upwardly mobile prices face resistance, while some coins hint at a potential drop if support breaks. Market outlooks point towards consolidation, but note players like Tom Lee predict potentially explosive moves if the recovery garners fresh fuel.

Bitcoin (BTC): Trading Range Narrowed

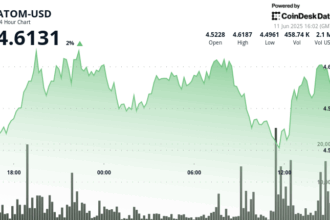

Bitcoin (BTC) is currently trading within a tight range of roughly $112,000 to $115,700. Market intelligence suggests this range represents a battle between bulls and bears, with neither side firmly in control.

Bitfinex analysts note the overall weakness and falloff of most altcoins signals a receding “speculative appetite,” fostering a climate of risk aversion.

Fundstrat’s Tom Lee fuels optimism, however, suggesting it could surge above $200,000 by the end of the year, possibly approaching an all-time high.

The immediate test for BTC is its 20-day SMA at $116,800. Sustaining this level could become a catalyst for a challenge towards higher territory. Failure, however, could see dips targeting $105,000.

Key breakouts would be above $120,000, subsequently testing the previous ATH of $123,218.

Ethereum (ETH): Mild Bullishness Prevails

Ethereum (ETH) saw buyers push its price towards the $3,745 barrier but lacked the steam to surpass it completely.

A positive note for ETH bulls: buyers have staunchly defended recent gains, indicating readiness for another upward push.

The next upside target if the $3,745 hurdle is cleared includes $3,941 and $4,094.

Defeat for the bulls would involve breaking below the significant $3,300 level (61.8% Fibonacci Retracement), potentially triggering a decline towards the 50-day SMA at $3,058.

Key Statistics for Ethereum (ETH)

| Current Range | $3,058 (50d SMA) to $3,675 (20d SMA) |

| Bullish Target | $3,941 / $4,094 |

| Bearish Trigger | Break below $3,300 (Fibonacci Retracement) |