Crypto Market Update: Two Key Developments This Week

In brief

At least five law firms have filed copycat class action lawsuits against Bitcoin treasury firm MicroStrategy, accusing the company of misrepresenting risks associated with its Bitcoin investments.

Lawyers from these firms are vying for positions as lead counsel in the consolidated case, with the potential to earn substantial contingency fees.

Coinbase reached a new all-time closing price Thursday at $375.07 and announced plans to launch U.S.-regulated Bitcoin and Ethereum perpetual futures next month.

Strategy’s Litigation Strategy

Multiple law firms have filed identical class action lawsuits against MicroStrategy (MSTR) over claims the company misrepresented the risks of its Bitcoin treasury strategy.

The filings appear to be a standard practice in class action litigation where firms signal their interest in leading the case. The outcome typically depends on who has the most stake in the case, making institutional investors like pension funds prime candidates for lead plaintiff status.

Legal experts suggest these identical suits demonstrate the “tens of millions of dollars” in potential fees at stake for lead counsel in major cases.

Coinbase’s All-Time High and Futures Plans

Coinbase (COIN) stock reached a new all-time high of $375.07 Thursday amid optimistic analyst projections. Firms have set lofty price targets, with Bernstein suggesting $510 as a potential valuation.

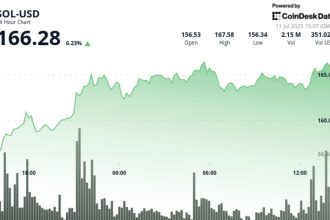

The exchange continues to expand its services, planning to launch regulated perpetual futures contracts for Bitcoin and Ethereum next month. Crypto data shows these products have generated significant trading volume, including $382 billion in the past month.

Meanwhile, Base (Ethereum’s layer-2 network) has expanded its wrapped assets, now including Cardano and Litecoin to its existing portfolio.

Other Key Developments

- Bakkt is diversifying its services after selling its crypto custody arm and pivoting toward a “stablecoin payments” product.

- Bitwise’s Dogecoin and Aptos ETF filings received amended S-1 submissions following discussions with the SEC, signaling a shift in regulatory attitudes.