This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

With a flurry of economic data released today, it is evident that despite the ongoing tariff disputes, the U.S. economy remains resilient.

Retail Sales

Retail sales figures today exceeded market expectations:

- Retail sales (month-over-month): Actual 0.6%, Expected 0.1%

- Retail sales (control group): Actual 0.5%, Expected 0.3%

- Retail sales excluding autos: Actual 0.5%, Expected 0.3%

It is crucial to note that retail sales data is nominal and thus incorporates inflation. In an era of persistently elevated inflation, this factor gains importance.

While nominal figures show strength, real purchasing power continues to decline. A chart from economist Parker Ross illustrates this phenomenon, highlighting why a significant recession remains challenging amidst inflationary pressures.

A recession could occur in real terms, potentially decoupling from nominal GDP growth, resulting in reduced purchasing power even without a nominal decline in spending and income.

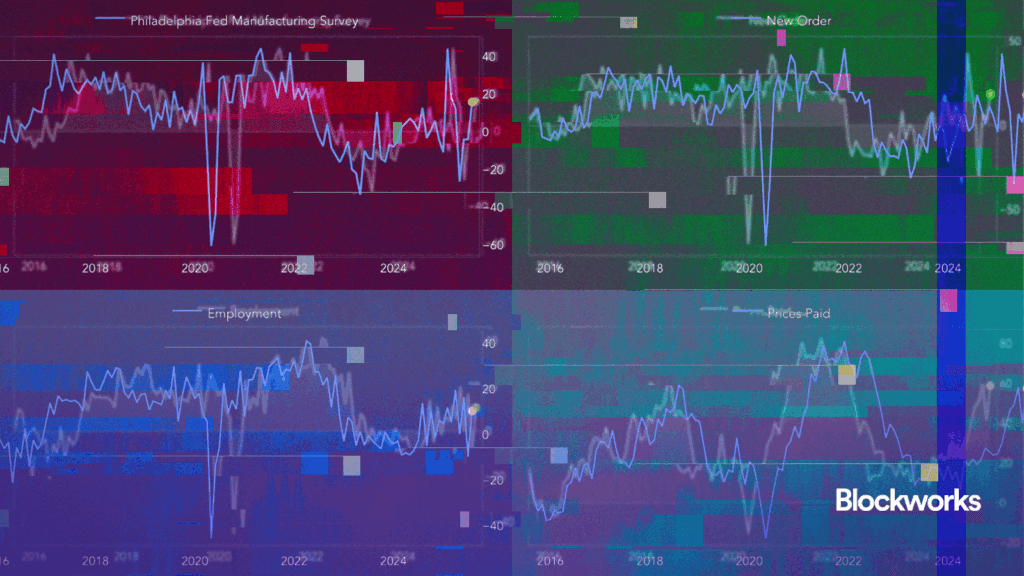

Philly Fed Survey

Data from the Philadelphia Fed survey indicates economic recovery following recent uncertainty. The survey demonstrates adaptation to current tariff levels:

- Philly Fed CAPEX index: Actual 17.10, Previous 14.50

- Philly Fed employment: Actual 10.3, Previous -9.8

- Philly Fed new orders: Actual 18.4, Previous 2.3

- Philly Fed prices paid: Actual 58.80, Previous 41.40

Jobless Claims

Weekly jobless claims reinforce the notion of a surprisingly robust U.S. economy:

- Initial claims pleasantly surprised, showing a continued downward trend.

- Continuing claims also exceeded expectations, indicating a stabilization in the job market.

The divergence between initial and continuing claims offers valuable insights into the labor market. A “solid enough” economy prevents widespread layoffs but struggles to provide new employment opportunities, causing longer durations on continuing claims.

Overall, soft and hard data indicate an improving economic landscape.