The Securities and Exchange Commission (SEC) has approved the conversion of Grayscale’s Digital Large Cap Fund (GDLC) into a spot exchange-traded fund (ETF), a filing shows.

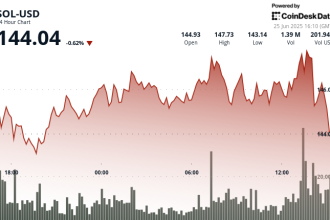

The fund tracks the price of bitcoin

, ethereum

, XRP , Solana

and Cardano

. The majority of the fund’s weight, currently about 80%, is in bitcoin. The SEC’s letter on Tuesday noted that the fund is benchmarked to the CoinDesk 5 Index (CD5).

GDLC was launched in February 2018 and has since attracted nearly $755 million in assets under management. It has a 2.5% expense ratio.

Baehr said the fund will become the largest multi-token digital asset ETF in the world.

Crypto asset manager Bitwise is next in line to receive a decision from the SEC to convert its Bitwise 10 Crypto Index Fund (BITW) into an ETF. BITW holds 79% in bitcoin and the rest in ether, XRP, SOL, ADA, Sui

, Chainlink

, Avalanche

, Litecoin

and Polkadot

.