SEC Urges Solana ETF Applicants for Amended Filings

The US Securities and Exchange Commission (SEC) has directed prospective issuers of Solana exchange-traded funds (ETFs) to submit revised S-1 registration forms within the next week, according to three sources familiar with the matter, reported Blockworks.

Agency officials informed issuers that comments on the S-1 documents would be provided within 30 days of their submission, two additional sources indicated.

The SEC requested updates focusing on language detailing in-kind redemption procedures and strategies for portfolio staking, reported two sources. Notably, the agency appears receptive to incorporating staking activities into a Solana ETF, the sources added.

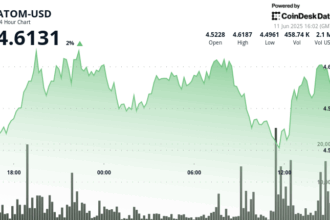

A source estimated that implementing these changes could position Solana ETFs for SEC approval within three to five weeks. Bloomberg Intelligence analyst James Seyffart, quoted by Blockworks, anticipates approval this year, potentially as soon as July.

“We think the SEC may now focus on handling 19b-4 filings for Solana and staking ETFs earlier than planned. Issuers and industry participants likely have been working alongside the SEC… but the final deadlines for the agency’s decisions on such applications aren’t until October,” Seyffart noted.

Crypto ETFs provide regulated access to the spot price of underlying cryptocurrencies. Several firms are seeking approval, including Fidelity, Franklin Templeton, VanEck, Bitwise, Canary Capital, 21Shares, and Grayscale. Regulatory bodies and some issuers declined immediate comment.

The SEC previously delayed a ruling on Grayscale’s Solana ETF filing, citing insufficient information. In February, the regulator formally accepted the filing, a significant shift acknowledged by Seyffart as removing a key obstacle previously faced by SEC Chair Gary Gensler. He predicted high approval rates for crypto ETFs this year.

The approval process is supported by market developments, including CME launching Solana futures in February, mirroring precedents for Bitcoin and Ethereum ETF approvals.

This is a developing story.