Portnoy’s Early Exit from XRP Misses Surge as Cryptocurrency Soars

- Barstool Sports founder Dave Portnoy explained his sale of XRP (Ripple) holdings before a significant price increase.

- Portnoy attributed the sale to advice suggesting XRP faced pressure due to Circle’s activities.

- XRP reached a seven-year high of $3.65, breaching a long-standing record.

- Ripple co-founders (who created XRP) have sold billions previously, facing an SEC settlement.

Less than a week after Dave Portnoy, founder of Barstool Sports, confirmed selling his XRP before a subsequent price surge, he elaborated on this sale during a daily trading broadcast.

Last month, Portnoy publicly acknowledged missing out on substantial gains by selling his XRP holdings early. His stake was sold around the $2.40 price point not long before XRP surged to a new all-time high of nearly $3.65.

On Monday, Portnoy detailed his reasoning for selling. He described XRP being “rangebound” between $2.10 and $2.40. Citing an unnamed advisor he refers to as his “XRP guy,” Portnoy stated this external influenced his decision: “He’s like, ‘Hey, not good news that Circle is gonna do what XRP is doing.’ I don’t even really know what he’s talking about.”

Despite his confusion and skepticism about the cited reason, Portnoy acted on the advice. He liquidated his position just before the market rallied. “No sooner did I sell it, the thing went parabolic,” Portnoy commented, acknowledging his mistake. He noted subsequent valuations near $3.50 increased the “hurt.” Portnoy admitted the sale remains a costly error but argued that the timing was the result of his advisor’s questionable input.

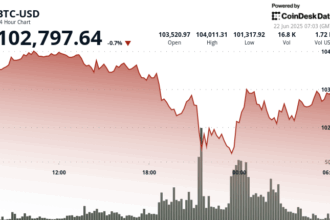

XRP’s meteoric rise was underpinned by broader market factors. President Trump’s election win in November energized the crypto market generally, while the impending conclusion of the long-running SEC’s suit against Ripple added to the bullish sentiment. Furthermore, the prospect of regulated ETFs based on XRP attracted institutional interest. The cryptocurrency definitively broke its seven-year-old high barrier.

Ripple began with its co-founders creating the cryptocurrency. The company itself has a documented history of selling large quantities of its accumulated XRP supply over the years, reportedly worth billions. While the SEC lawsuit from late 2020 alleged securities law violations against Ripple, the agency later settled with Ripple (not its co-founders), requiring only a modest fine. The underlying lawsuit alleged that XRP acted as an unregistered security.

Though the specific peak mentioned was reportedly passed by Monday, XRP remained precariously close to $3.65, affirming the recent breakout.

In the broadcast where he confessed to the error, Portnoy is seen expressing satisfaction with his holdings in Bitcoin and Ethereum. He admitted the XRP situation hurts but stated he remains “still doing good” overall. Portnoy is familiar with crypto investment regrets, previously apologizing to Bitcoin holders for panic selling it after a dip in 2021.