SOL’s ETF-Driven Rally Reverses, Technical Weakness Persists Amidst Broader Crypto Bear Market

Key Takeaways

-

SOL’s 5% rally to $160 following ETF news reversed entirely within 24 hours, highlighting persistent technical weakness.

-

SOL trades near a key $144.5–$147.7 supply cluster. A breakdown below $144 could trigger a drop to $124 or even $95–$100.

-

Bitcoin’s weakness continues to be a significant drag on SOL’s performance.

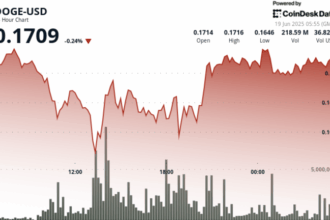

SOL (SOL) experienced a sharp, short-lived rally of 5% to $160 on Monday, driven by news of its first exchange-traded fund (ETF) enabling trading on Wednesday. However, the momentum proved ephemeral as the price promptly erased all gains within 24 hours, underscoring deep-seated technical weakness across multiple time frames.

Technical Analysis: Short-Term Pressures

On lower time frames, SOL has failed to sustain a position above the crucial 50-day and 200-day exponential moving averages (EMAs) for over a month, despite several bullish break-of-structure signals, including last week’s pop above $148.

The $148 level is currently facing selling pressure, and a breach below $137 would mark a lower low, diminishing the likelihood of near-term bullish momentum. Any sustained recovery above $160 following a recent test of the $145–$137 demand zone would signal a potential shift in short-term dynamics.

Broader Trend Remains Bearish

On higher time frames, SOL’s overarching trend remains bearish. The cryptocurrency struggled in May, failing to breach $180—a key resistance zone established earlier—since the beginning of the year. SOL has since traded within a descending channel, mirroring Bitcoin’s performance.

Despite Bitcoin hovering near all-time highs, SOL has fallen nearly 50% since January 19, reflecting relative underperformance against the leading cryptocurrency. SOL’s sensitivity to BTC’s trajectory is stark—a decline in BTC often precedes weakness in SOL.

If the bearish momentum holds, a retest of the daily order block between $120 and $95 appears plausible. This area could present a more attractive long-term entry point for investors. Conversely, a strong daily close above $160 could potentially reverse sentiment and accelerate a short-term uptrend into higher price levels.

SOL Price Stability: The Role of UTXO Realized Metrics

SOL currently trades near $148, where Glassnode data points to a supply cluster centered around $144.5–$147.7. This zone holds 14.3% of the circulating supply, suggesting strong holder concentration. Maintaining a position above $144.5 is critical; a breakdown below $144 could potentially trigger a cascade of selling.

Limited supply buffers exist below, with the $100-$101 zone holding 3% of the supply and $124 supporting 1.58%. Failure to defend the $144 level increases the risk of a deeper decline towards these resistance levels, where thinner supply might lead to amplified volatility.

Resistance is evident near $157, where 5.55% of supply is concentrated, posing a significant hurdle to upward movement.