Crypto Market Trends: Bitcoin Strengthens, Ethereum Breaks Consolidation, Solana Shines

KEY TAKEAWAYS THIS WEEK:

- Bitcoin posts a solid 7% weekly gain to $107,550, maintaining above key support levels as institutional accumulation continues.

- Ethereum bounces 12.2% to $2,474, finally breaking above its 50-day EMA after weeks of consolidation.

- Solana is the star performer in the top 10 by market cap with a 16.5% weekly spike, driven by positive regulatory developments.

This week, Bitcoin (BTC) remains steady above the $107,000 level as traders monitor upcoming macroeconomic data, Federal Reserve commentary, and geopolitical signals entering June’s final month. Institutional accumulation persists and provides underlying strength.

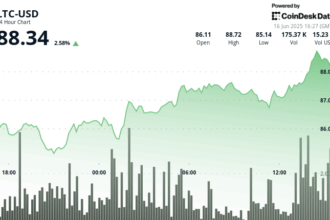

Ethereum (ETH) has finally managed a significant bounce, climbing 12.2% to $2,474 and breaking above its crucial 50-day EMA after weeks of consolidation. This technical break offers a potential catalyst for further gains, although divergence from Bitcoin’s strength on longer-term averages suggests caution is still warranted.

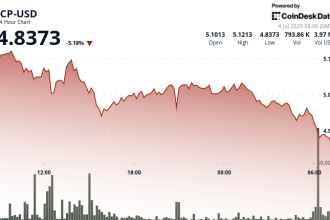

Solana (SOL) leads major coins this week with a 16.5% weekly surge driven by U.S. regulatory progress towards approving spot exchange-traded funds (ETFs). This momentum pushes prices towards the $158 level, decisively reclaiming key moving averages.

Meanwhile, broader market conditions support crypto assets. The S&P 500 is up 2% year-to-date, with the tech-heavy Nasdaq poised for record levels. Recent easing in Middle East tensions has alleviated energy market pressures, contributing to broader risk-off sentiment cooling.

Bitcoin (BTC): Building Bullish Momentum

The weekly chart displays strengthening bullish signals.

- BTC is trading above its 50-day EMA ($87,918) and consolidating its position above the longer-term 200-day moving average.

- The widening gap between the 50-day and 200-day EMAs signals sustained upward momentum and attracts trend-following traders.

Ethereum (ETH): Breaking Free from Consolidation

Ethereum shows signs of breaking its previous consolidation range.

- A key technical break has occurred above the 50-day EMA ($87,918).

- Price is currently testing resistance near the 50-week EMA (~$2,552).

Solana (SOL): The Week’s Outperformer

Solana sets clear terms after its decisive weekly breakout.

- The move higher demonstrates strong follow-through from the ETF regulatory news.

- This move successfully cleared the dense accumulation volume zone ($100-120).

Technical levels provide crucial guardrails for risk management:

Key Levels

- Bitcoin:

- Immediate support: $102,000

- Strong support: $100,000

- Immediate resistance: $110,000

- Strong resistance: $115,000

- Ethereum:

- Immediate support: $2,250

- Strong support: $1,500-$1,750

- Immediate resistance: $2,552

- Strong resistance: $2,707

- Solana:

- Immediate support: $140

- Strong support: $100-120

- Immediate resistance: $160-180

- Strong resistance: $200-210

Institutional accumulation (BTC) and positive ETF regulatory developments (SOL) are key drivers of this week’s performance. For Ethereum, the post-breakout momentum will be tested against resistance near the 50-week EMA. Ongoing market conditions suggest medium-term support, but further concrete catalysts will be needed to sustain significant upward movement.

Disclaimer: The views and opinions expressed here are for informational purposes only and do not constitute financial, investment, or other advice.