The stablecoin market could start reshaping traditional finance if it grows to about $750 billion, according to Geoff Kendrick, Standard Chartered’s head of digital assets research.

Kendrick, writing in a note Tuesday after a week-long trip through Washington, New York and Boston, said there’s a growing consensus among crypto industry players, fund managers and policymakers that this $750 billion mark would be the tipping point where stablecoins begin to influence government debt issuance, monetary policy and the structure of U.S. Treasury markets through sheer demand.

The current stablecoin market stands at about $240 billion. But Kendrick’s contacts expect it could more than triple by the end of 2026, driven by broadening use and regulatory clarity, particularly if the bipartisan GENIUS Act becomes law — a move that could happen as early as next week.

“In the U.S., once the stablecoin market gets to a certain size, the amount of T-bills required to back stablecoins will likely require a shift in planned issuance across the curve towards more T-bill issuance, less longer-tenor issuance,” Kendrick wrote. “This potentially has implications for the shape of the U.S. Treasury yield curve and demand for USD assets.”

Stablecoins — cryptocurrencies designed to maintain a fixed value, usually $1 — are typically backed by cash-equivalent reserves, most often short-term U.S. government debt. As demand rises, so too does the need to hold vast quantities of Treasury bills, putting stablecoins on a potential collision course with traditional fixed income markets.

Kendrick met with a cross-section of market participants during his U.S. visit, including Bitcoin miners, crypto-native firms, traditional hedge funds and policymakers, he said. Their near-unanimous focus: stablecoins.

Market participants expect a wave of stablecoin issuance, not just from crypto firms, but possibly from banks and even local governments.

Emerging markets may be the most immediately affected. Kendrick flagged concerns that individuals in these regions are using stablecoins as a digital savings vehicle, pulling capital away from local banking systems and central bank reserves. That could challenge financial stability in countries that rely on U.S. dollar liquidity to manage fixed exchange rates or capital controls.

On the U.S. front, stablecoins could shift corporate treasuries away from traditional banking and into tokenized cash alternatives. But how much of their cash businesses move on-chain — and how fast — remains uncertain.

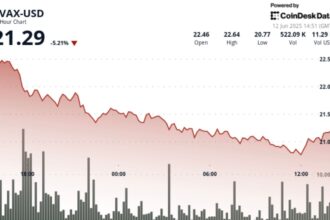

The growing attention is reflected in public markets. Shares of Circle (CRCL), the issuer of the USDC stablecoin, have surged 540% since its public debut last month. The run-up signals investor confidence in stablecoins as a central pillar of the next phase of digital finance.