SUI

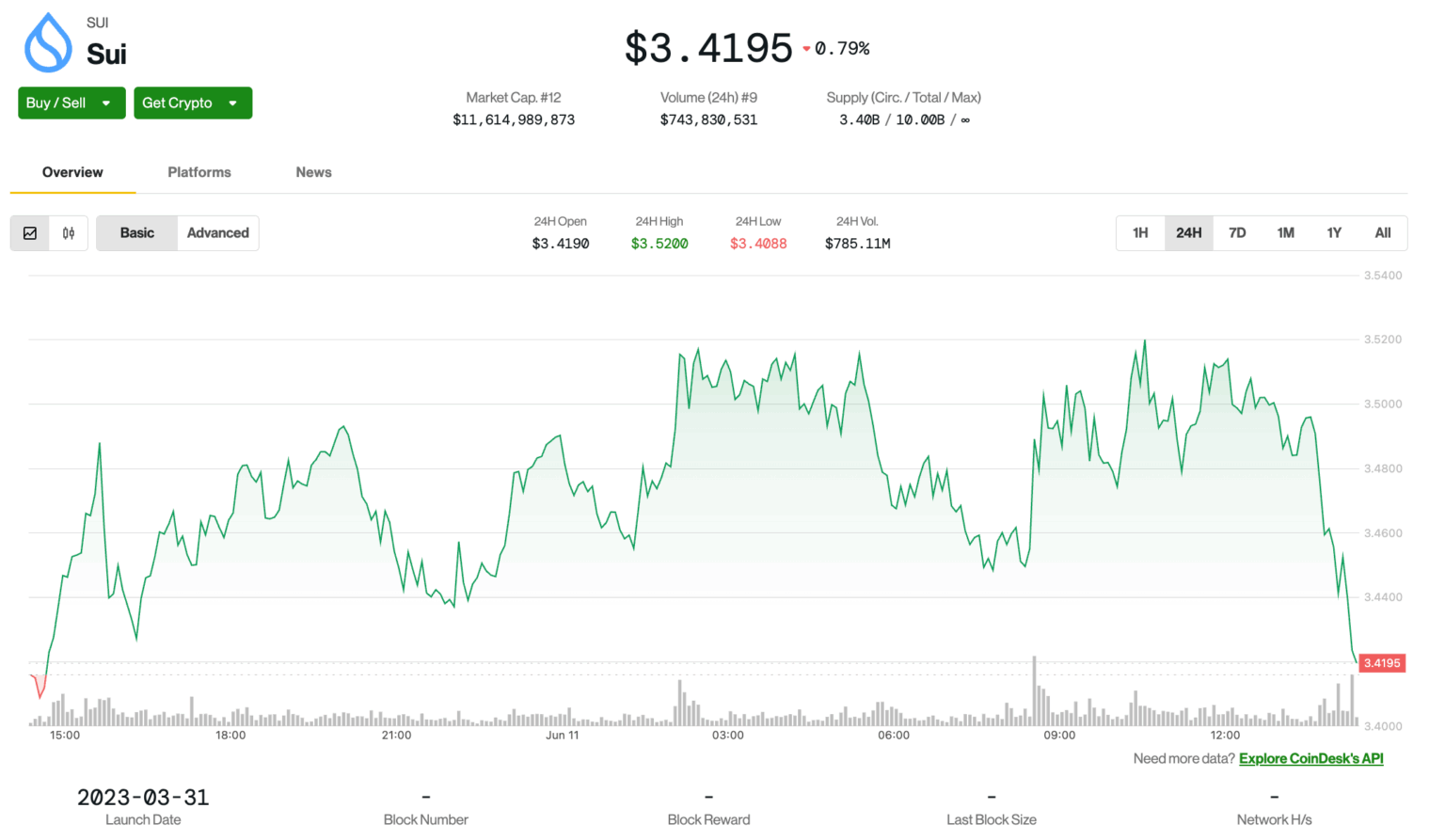

, the native token of the Sui blockchain, rose slightly over the past 24 hours before falling sharply after macroeconomic factors hit global markets during U.S. afternoon hours..

The token rose following news that Nasdaq filed a 19b-4 form with the U.S. Securities and Exchange Commission (SEC) to list the 21Shares SUI exchange-traded fund. This marks the second major step in the ETF approval process. The first, a draft S-1 registration statement, was filed by 21Shares in April.

If approved, this would be the first spot SUI ETF listed in the United States, offering traditional investors regulated access to the native token of the Sui blockchain.

Technical analysis highlights

- SUI experienced a decisive breakout overnight above the $3.49 resistance level with volume exceeding 13 million, significantly above the 24-hour average of 8.7 million.

- Despite minor pullbacks, the token found consistent support around $3.45-$3.46.

- A High-volume surge reinforced bullish sentiment, suggesting potential continuation of upward momentum.

- The $3.50 level has been established as a potential key resistance zone following a temporary exhaustion of bullish momentum.

- Price action formed a potential base in the $3.48-$3.48 range with moderate volume supporting consolidation.