US Stocks Rally Amid EU-Tariff Pause, Consumer Confidence Boost

US stocks surged on Tuesday as investors reacted positively to signs the administration is poised to negotiate a deal with the European Union regarding previously threatened tariffs, offset by unexpectedly strong consumer confidence data for May.

Trade War Developments

Following strong weekend trading gains, S&P 500 and Nasdaq Composite futures climbed, reversing Friday’s declines. As of 2 p.m. ET, the indexes were trading 2% and 2.5% higher respectively.

The rally reversed sharp losses triggered by President Trump’s Friday threat to impose a 50% tariff on EU goods and a 25% tax on iPhone sales. By late Sunday, President Trump announced a pause on planned duty increases until July 9.

“Talks will begin rapidly,” Trump wrote in a Truth Social post late Sunday.

Tech Sector Movement

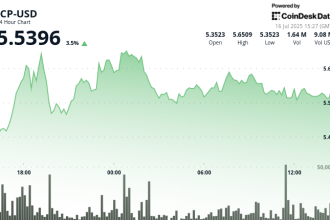

Tech shares, hit hard Friday after Apple (AAPL)’s futures opened 3.5% lower due to the phone tax threat, recovered decisively Tuesday. As of 2 p.m. ET, Apple climbed 2.7%, reversing early losses.

Administration officials sought to mitigate market jitters, with National Economic Council Director Kevin Hassett stating on CNBC, “they don’t want to harm Apple.” Apple shares are temporarily trading just below their level last Thursday.

Consumer Confidence Improves

The encouraging rally Wednesday morning followed the surprising release of the latest consumer confidence survey. The May index jumped 12.3 points month-over-month to reach 98, significantly exceeded analysts’ expectations of 87.

The data suggests households are cautiously optimistic regarding the economic outlook despite ongoing trade tensions, even while acknowledging the likelihood of seeing higher prices.

Next Economic Watch

The Federal Open Market Committee (FOMC) will release meeting minutes Thursday, drawing significant market attention. Investors will seek indications from central bankers regarding their thinking on potential future interest rate actions, particularly in the event tariffs persist.

March minutes indicated Committee members were committed to waiting for further data before shifting monetary policy in response to trade-related economic headwinds.

Keep an eye on your inbox tomorrow for further analysis.