Bitcoin Market Analysis: LTH Profits & Unprecedented Volatility

Long-Term Holder Activity & Profit-Taking

A unique dynamic is shaping the current Bitcoin bull market. While prices hover near their all-time high of $111,800, long-term holders (LTHs), defined as those holding BTC for over 155 days, are taking significant profits.

Key Takeaways:

- The net realized profit/loss for LTHs peaked recently at $930 million daily.

- Despite this selling pressure, the overall supply held by LTHs continues to increase.

- This contrasts sharply with previous market cycles, where LTH supply typically decreased during late-stage rallies.

Data provider Glassnode describes this behavior as a “unique duality,” where selling occurs simultaneously with ongoing accumulation. Institutional investment and the availability of US spot Bitcoin ETFs, which favor long-term custody, are seen as key drivers behind this late-cycle accumulation despite significant gains.

The realized profit/loss ratio reaching 9.4 further supports this narrative, indicating that long-term coins spent in the market were predominantly held at substantial gains. Historically, such metrics have coincided with market euphoria and sometimes preceded tops, though persistence can occur if demand remains strong.

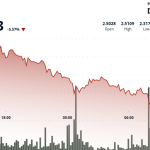

Lower Volatility at New Highs

Contrary to typical market volatility at ATH levels, recent data indicates Bitcoin’s risk profile has significantly lowered, presenting what analysts view as an unusual condition.

Sources:

- Ecoinometrics: Bitcoin’s weekly volatility has dropped to the 10th percentile since 2015, the lowest level in a decade despite ATH price appreciation.

- Derivatives market data (ATM IV) suggests expectations of minimal upcoming price dislocations.

- However, realized supply density indicates a tightly clustered ownership near the current $105k-$110k buying zone.

This combination—price near an ATH, unusually low volatility, and a dense supply concentration—creates a seemingly stable environment favored by institutions seeking risk-adjusted returns. Yet, analysts caution this stability may be “tightly wound.” A sharp sentiment crack could trigger a deeper pullback than volatility data suggests, while sustained demand could potentially drive Bitcoin even higher by pushing through the current volatility ceiling.

This analysis does not constitute investment advice. Trading and investing in digital assets involves significant risk.