MARKET ANALYSIS

Record-Breaking High for Bitcoin Coincides with Weak Treasury Auction

Witnessed an unforgettable day? A new Bitcoin high coincided with weakness in US long-dated Treasury bonds yesterday.

Bitcoin surged past the $110,000 mark, touching an intraday record high of $109,888 during the afternoon session.

Bond Market Disarray

This occurred alongside declining bids for the benchmark 20-year Treasury. The yield on these notes climbed to 5.1%, the highest level seen in weeks, as demand fell short of expectations.

Concurrently, the 30-year Treasury yield surged by 11 basis points to surpass the 5% threshold, while the 10-year yield rose to 4.6%.

Market Moves

The adverse auction results drove significant losses in US equities shortly after release. The S&P 500 index retreated 1.2% around 1 p.m. ET, while the Nasdaq Composite index, down 1.4%, erased earlier gains.

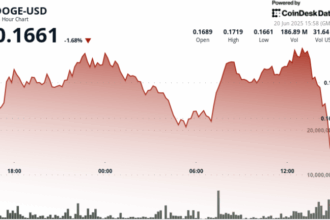

Bitcoin briefly pulled back near its $110,000 peak but remained up approximately 1% year-to-date according to some trackers.

Surprising Behavior

Despite rising Treasury yields, often associated with risk-averse sentiment in markets, the cryptocurrency bucked the trend. Bitcoin’s performance suggested characteristics of a safe-haven asset rather than a typical risk asset.

Expert Commentary: No Rush to Judgment

Noelle Acheson of the Crypto is Macro Now newsletter advises caution against labeling this “decoupling.”

Acheson suggests the primary concern is a potential contagion from the Japanese bond market.

Japanese Market Drivers

Recent yield increases on Japanese 30- and 40-year bonds, reaching record highs above 3%, may contribute to yen strength.

Rising yields on Japan’s 20-year bonds Tuesday marked the weakest demand for a Japanese Treasury auction in over a decade.

Labor Market Uncertainty

Demand for Treasury bonds weakening means further commentary on the US labor market likely took a backseat.

Upcoming initial jobless claims data for the week ending May 17 will provide the next clue on labor market resilience.

Sector Headwinds

Overall risk sentiment faces challenges despite the unusual Bitcoin performance.

Analysts have significantly lowered S&P 500 earnings expectations for the current quarter, down from an initial projected 8.9% growth to 4.8%. The ongoing trade war remains a concern.

An ongoing trade war has analysts pulling back on S&P 500 earnings expectations for the rest of the year

Broader concerns about tariff impacts on the labor market and domestic GDP also weigh on sentiment.

While the bond market backdrop remains uncertain and macroeconomic data is scarce for trading catalysts, the simultaneous rise of Bitcoin and US Treasury yields—often unconventional market moves—underscores the complexity of the current environment.

* Note: This analysis is based on published reports and market activity. Market conditions are fluid and analyses should be approached with standard investment caution.*