CEA Industries Announces New $1.25 Billion BNB Treasury

A consumer products firm majority-owned by MicroStrategy () revealed Monday its plan to acquire significant amounts of Binance’s BNB cryptocurrency, driving its stock price up over 700%.

Core Developments

- CEA Industries (VAPE) aims to raise a total of $1.25 billion (including initial $500m) likely using funds raised via a private placement.

- The company, partnering with 10x Capital and YZi Labs, reported a nearly 700% stock jump following the announcement.

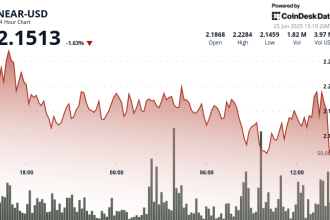

- Binance’s BNB briefly hit an all-time high, and CEA intends to start buying it immediately after a PIPE deal closes on July 31.

- The firm seeks to scale treasury holdings over the next 12-24 months, potentially exploring revenue-generating activities like staking.

About CEA Industries

Based in Canada (headquartered in Vancouver), CEA is a vape market company that recently finalized its acquisition of Fat Panda, a leading retailer and manufacturer. They adopted the ticker VAPE last month.

Financial Structure

Closing of a $500 million PIPE is expected by July 31, alongside $750 million in potential proceeds from warrant exercises, constituting the treasury’s plan.

BNB Context

Binance’s native token, BNB, rose to an all-time high and is outperforming Bitcoin recently despite broader market corrections. It ranks as the fifth largest cryptocurrency by market cap.

Precedent & Significance

Citing MicroStrategy’s earlier Bitcoin-focused treasury model, CEA aims to open institutional crypto investing through U.S.-listed equities, as stated jointly by partners 10x Capital CEO David Namdar and investor Ella Zhang (head of YZi Labs, formerly Binance Labs). Earlier BNB treasury announcements also impacted the issuer’s stock performance.

Binance’s Role

Participating investor YZi Labs (formerly Binance Labs) is a family office connected to Binance founders Changpeng Zhao and Yi He.