XRP Shows Institutional Backing as Key Price Levels Crystallize

Key takeaways:

- Increasing institutional demand for XRP ETPs and persistent whale accumulation underpin the bullish case for XRP price.

- XRP must close above $2.30 daily to secure a push toward $3.00.

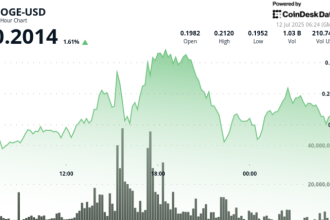

XRP (XRP) displayed volatility on June 30, down 0.8% over the last 24 hours to trade at $2.17. Despite the slight dip, the cryptocurrency remains above the $2.00 threshold as analysts highlight critical resistance levels needed for new all-time highs.

Institutional Demand Increases for XRP Investment Products

According to CoinShares data, institutional interest in XRP investment products is on the rise. XRP exchange-traded products (ETPs) saw inflows of $10.6 million during the week ending June 27, bringing total year-to-date inflows to $219 million.

Related: XRP price saw a 420% month-long rally the last time this metric turned green.

Other top-cap altcoins like Bitcoin (BTC), Ether (ETH), and Solana (SOL) recorded strong net inflows of $2.2 billion, $429.1 million, and $5.3 million respectively, indicating growing institutional appetite for XRP.

CoinShares research head James Butterfill attributed this resilient investor demand to “heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy.”

“We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy.”

Furthermore, whale accumulation continues to rise, with entities holding between 1 million-10 million XRP now owning 9.9% of the total supply—a 65% increase since late November 2024. XRP has rallied approximately 350% since that period.

This accumulation trend persisted even during XRP’s 35% pullback to $1.60 between January and April, suggesting long-term holders are strategically building positions for potential gains.

Key Price Levels Define XRP’s Next Move

XRP faces a crucial test near the $2.60 resistance level, which would need to convert into support for targeting higher highs above $3.00.

First, however, the XRP/USD pair must close above the $2.20-$2.30 consolidation zone on the daily chart.

According to pseudonymous analyst Dom on X (formerly Twitter), this $2.20-$2.30 zone represents a convergence of multiple technical levels:

“All this confluence tells us one thing: this is a big area for bulls to regain that may very well be looked back at as the turning point of a new bullish trend.”

Key moving averages are positioned within this zone: the 100-day SMA at $2.20, the 50-day SMA at $2.25, and the 200-day SMA at $2.36.

If XRP breaches the $2.20 level, analysts suggest potential upside toward $3.81 by July. Conversely, bears aim to maintain resistance at $2.20 to create conditions for testing $2.15.

The next significant support area would be the psychological $2.00 level, with deeper resistance clustered between $1.95 and $1.90—a level touched off by US airstrikes on Iran’s nuclear sites on June 22.

Every investment and trading move involves risk. This article is not investment advice. Readers are encouraged to conduct their own research before making decisions.