In Brief

- On-chain data indicates a 3,000 BTC move by dormant “whales,” a development frequently preceding local tops.

- Bitcoin’s options skew reversed negative, reflecting heightened demand for downside protection.

- Spot Bitcoin ETFs experienced net outflows, while halted inflows signal reduced institutional appetite.

Bitcoin’s August rally faces contradictory signals pointing to potential pause. Key indicators suggest long-term holders may be crystallizing gains while sellers gain footing.

Analysis

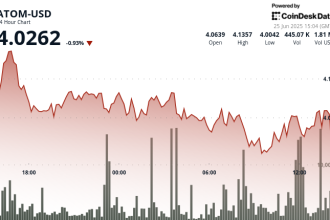

Historical precedents are being cited following dormant whale movement of roughly 3,000 BTC Tuesday. This cohort, inactive for seven to ten years, has previously coincided with local tops.

The timing echoes previous bearish momentum near a 6% drop after similar whale activity was detected.

Additional bearish readings converged Tuesday:

- Futures taker sell volume reached August 1 and July 30 peaks, signaling aggressive exiting.

- Options skew flipped deeply negative (+2% to -2%) over the past 30-days, indicating investors are increasingly hedging against declines.

- Bitcoin ETFs saw net outflows of $1.2 billion recently, amplifying sell-side pressure.

Divergences were cited by market observers. Following a “hawkish FOMC meeting and better-than-expected economic data,” CoinShares noted its digital product inflows ceased after $223 million outflows during the prior week.

Decentralized finance founder Georgii Verbitski observed, “Sideways trading through August is the most probable scenario before momentum resumes.” However, these challenges reflect broader macroeconomic uncertainty and market breadth issues identified by analysts.

Despite these signals, Verbitski maintained an overall “positive” market trend, but acknowledged near-term volatility. Factors cited included ongoing uncertainty around U.S. tariffs and macroeconomic conditions.

Crypto Context

August’s performance, down 1.5% according to CoinGecko, diverges historically from most months (+0.96% median) but aligns with broad institutional risk reduction.