This is a segment from the Empire newsletter. To read full editions, subscribe.

Shift in Crypto Narrative: Memecoins Replace Traditional Altcoin Seasons

Unlike memecoins, which analysts at Blockworks Research believe will persist despite market fluctuations, traditional altcoin seasons (szn) may not return with previous intensity, according to K33’s analysis.

Author David Zimmerman posits that the 2020/2021 market cycle represents the zenith of crypto mania.

“Without fresh retail capital inflows, the calculus becomes challenging for speculative tokens lacking revenue streams, concrete products, or substantive roadmaps beyond social media sentiment,” Zimmerman stated in an analytical note.

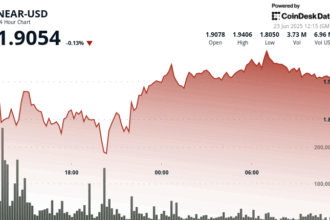

A key market transformation involves memecoins solidifying their position within the cryptocurrency ecosystem— offering investors a dependable alternative to narrative-driven projects.

Zimmerman noted that memecoins accounted for approximately 25% of crypto market volume at the peak of Q1— highlighting their growing significance in the market landscape.

The altcoin sector faces significant supply challenges in the coming months, with projected token lockups of $4.3 billion in May, $2.8 billion in June, and $3.2 billion in July— creating potential headwinds unless met with substantial new capital inflows.

“Without a significant boost in demand or retail participation, it’s clear: increasing token supply confronting stagnant or declining demand inevitably exerts downward pressure on valuation,” the analyst observed.

Market conditions have evolved beyond reliance on speculative narratives; fundamental analysis is now essential for investment decisions outside the memecoin space.

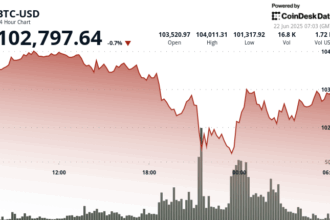

Bitcoin maintains dominance, yet opportunities exist for smaller altcoin allocations according to K33. However, “windows to participate meaningfully remain limited—and increasingly ephemeral.”

As the market matures, token-based speculation may yield to other asset classes— including stablecoins, which Zimmermann identifies as potentially the most promising alternative to Bitcoin among crypto assets.

Investors now face the imperative of conducting due diligence— examining product-market fit, user adoption metrics, and revenue viability—unless they target the established memecoin segment.

The era of dramatic, rapid altcoin rallies appears waning as the crypto market transitions toward greater institutional adoption and discernible market structure.