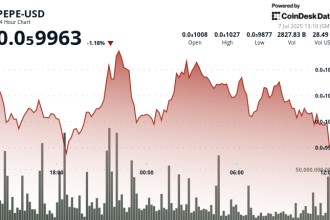

Bitcoin’s Volatility Slump Amid US-China Trade Negotiations

Geopolitical Calm Boosts Implied Volatility to One-Year Low

The resumption of U.S.-China trade talks at London’s Lancaster House has contributed to a significant drop in Bitcoin’s implied volatility, now sitting at its lowest level in the past year, according to market analysis firm QCP Capital.

Price Holds Near $108,000 Amid Range-Bound Trading

Despite the renewed focus on geopolitics, Bitcoin largely stays range-bound near the $108,000 mark, with its price up approximately 4.5% over the last month. This price stability occurred even after last week’s strong U.S. jobs report, which failed to move Bitcoin significantly.

Reserve Asset Appeal vs. Practical Limitations

Amid escalating U.S.-China tensions, Bitcoin’s appeal as a potential neutral reserve asset, uncontrolled by any single government or bloc, has increased. Its decentralized nature is seen as offering a hedge against currency weaponization and geopolitical volatility.

However, persistent concerns about the cryptocurrency’s inherent volatility, its relative illiquidity compared to traditional assets, and the risk of regulatory clampdowns limit its capacity to function as a widely accepted true reserve asset.

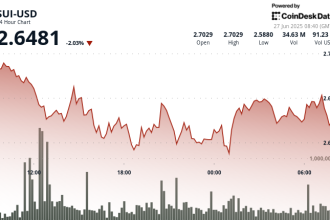

Market Sentiment: Bulls Expect But Bears Constrain

Market dynamics reflect this split view. While the open interest in call options on Bitcoin significantly outweighs puts (62% versus 38%), indicating a bullish sentiment on the day, overall price action suggests caution.

Financial firms like QCP Capital note that without a compelling macroeconomic narrative to drive the next significant price surge, signs of market fatigue are appearing as Bitcoin remains “caught in the cross-currents without a clear macro anchor.”