Crypto Market Slump Hit by Middle East Conflict

By [Your Name], June 13, 2025

Key Points

- The total crypto market cap fell 4% to $3.24 trillion following Israel’s attack on Iran.

- $1.15 billion in crypto futures liquidated, driven mainly by long positions.

- A technical analysis suggests the weekly uptrend remains intact despite recent volatility.

Market Reacts to Geopolitical Instability

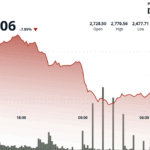

The combined valuation of the cryptocurrency market fell more than 4% in the past 24 hours, dropping to $3.24 trillion on June 13, in response to escalating tensions after Israel launched military strikes against Iran. Geopolitical instability, particularly in the Middle East, significantly impacted investor sentiment and global financial markets, including cryptocurrencies.

Israeli Prime Minister Benjamin Netanyahu stated the strikes targeted Iran’s nuclear program and other infrastructure, with operations continuing until “the threat is removed.”

Israel strikes targeted Iran’s nuclear program and “dozens of targets” across different areas, Israeli military official says

– CNN, June 13, 2025

The uncertainty over potential Iranian retaliation and wider conflict led investors to seek safety in traditional “risk-off” assets such as bonds, gold, and oil. Oil prices briefly rose above $72 per barrel for the first time in over four months, reflecting market concern over the potential for a new major conflict.

Cryptocurrencies experienced sharp declines. Bitcoin (BTC) dropped as much as 5.6% to $102,700 on Bitstamp, briefly falling below the $103,000 threshold. Ether (ETH) reached a 9.4% loss, while XRP (XRP) and Solana (SOL) dropped 5.8% and 9.6%, respectively. US stock index futures also saw declines on the news.

Widespread Liquidations Signal Sharp Correction

The price slump coincided with heavy liquidations in the crypto derivatives market. A total of $944 million was liquidated across all perpetual futures exchanges in the last 24 hours, dominated by $448 million specifically from long traders. This was the largest single-day liquidation volume since February 25.

Bitcoin and Ether accounted for the largest liquidation amounts ($448.1M and $288.4M respectively). Solana followed with $52.1 million in liquidated positions, while Dogecoin and XRP saw $27.6 million and $23 million liquidated, respectively.

Technical Analysis Points to Ongoing Uptrend?

The recent pullback follows an impressive rally within what was shaping up as a multi-month upward trend phase, during which the market cap increased over 51% to reach $3.5 trillion.

Price action subsequent to this rise has formed a classic “bull flag” technical pattern on the weekly chart, indicating a temporary consolidation phase after a strong upward trend.

A decisive breakout above the flag’s upper boundary (current round resistance near $3.24 trillion) could trigger a 58% upside target, lifting the market cap to approximately $5.05 trillion. The market remains technically in favor of the upside, with the current Relative Strength Index (RSI) at 57.

On the downside, a weekly close below the flag support level around $3.1 trillion could trigger further downside towards the 50-day simple moving average near $2.75 trillion, and potentially to the base of the flag formation at approximately $2.31 trillion.

DISCLAIMER: This article does not constitute investment advice. Investing and trading in cryptocurrencies involves significant risk.