Bitcoin Breaks Records Despite On-Chain Disconnect

In Brief

- Bitcoin closed June above $104,000, its highest monthly closing mark and best second-quarter performance on record.

- U.S. spot Bitcoin ETFs recorded nearly $4 billion in inflows during the month.

- Analysts suggest on-chain metrics often miss institutional buying, which tends to happen off-chain or through OTC desks.

Trading at All-Time Highs

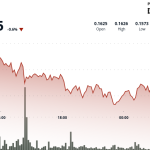

Bitcoin closed above the $104,000 threshold in June, marking its highest monthly close and delivering its strongest second-quarter performance to date.

Despite this success, traditional on-chain indicators suggested potentially weaker buyer demand.

Institutional Demand Drives Record ETF Flows

However, U.S. spot Bitcoin exchange-traded funds attracted significant inflows, totaling nearly $4 billion over the month. This included a peak $550 million on June 25, demonstrating robust and sustained institutional interest according to SoSoValue data.

The Disconnect Explained: Off-Chain Transactions

Market observers highlight a persistent disconnect between price appreciation and on-chain metrics. This stems from how institutions typically acquire Bitcoin – often through off-chain channels or large transactions that don’t register publicly on the blockchain.

“There are several reasons why on-chain data metrics do not tell us the full story,” explained Aslan Tashtanov, a blockchain engineer. “Institutional players tend to buy on centralized exchanges and through OTC desks, designed to handle large volumes without disrupting markets.”

“The result is a market dynamic where institutional capital moves prices without triggering conventional on-chain signals,” he added.

What Do The Signals Say

While spot retail trading activity remains relatively flat, cumulative balances of Bitcoin held in known OTC addresses are reported at historic lows by CryptoQuant.

Concurrently, average miner-linked balances have dropped nearly 18% year-over-year to roughly 156,000 BTC. While miners are significant holders whose activity is often correlated with institutional movements, OTC balances encompass broader institutional activity.

Institutional Infrastructure Challenges

“Large-scale institutional buying doesn’t show up in usual on-chain indicators,” noted Kony Kwong, CEO of GAIB. “This disconnect makes demand look weaker, even when capital continues to flow through institutional vehicles.”

Especially in the post-halving (April 2024) environment, where issuance is constrained, GAIB’s Kwong argues that reduced on-chain activity shouldn’t downplay the influence of institutional demand, capable of moving the market even with modest flows.

Market Performance Post-Halving

The April 2024 Bitcoin halving, reducing miner rewards by half, did not immediately spur significant price gains. In fact, a year on, the cryptocurrency posted its weakest performance period since the event, plummeting to around $75,000 early this year amid concerns over U.S. tariffs.

Supply and Liquidity Constraints

Despite the supply constraint from the halving limiting new Bitcoin creation, market reactions tend to unfold gradually and vary significantly, according to the analysis.

“The biggest reason [for off-chain activity] is actually a practical one,” Tashtanov noted. “There is simply not enough liquidity on-chain to facilitate institutional demand.”

Institutional Activity Driving Sui

Tashtanov pointed to other blockchains, citing Sui as an example, which “taken an active role in supporting institutional access to Bitcoin DeFi strategies,” accounting for over 10% of Sui’s total value locked. This infrastructure gap is spurring innovation beyond Bitcoin’s native layer.