Bitcoin Faces Crucial $109K Test Amid Market Uncertainty

With less than four days until the July 11 deadline and Bitcoin trading nearly at the psychologically significant $109,000 level, the digital asset has become a focal point of trader speculation. The outcome of this race appears equally likely to go either way, as conflicting technical signals and resistance levels create uncertainty.

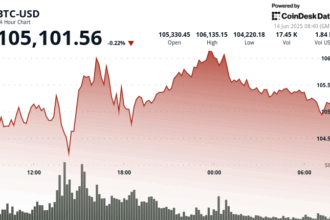

Market Standoff at $109K

Currently priced around $109,090, Bitcoin exists in a razor-thin margin above the $109,000 threshold that has historically capped rallies. Traders at prediction marketplace Myriad have placed their bets accordingly, with the market for “Bitcoin above $109,000 on July 11” currently trading near the 50-50 probability mark.

Chart Battles and Momentum Dilemmas

While Bitcoin maintains a technically healthy structure with its 50-day exponential moving average firmly above the 200-day EMA—a bullish configuration typically indicating an ongoing trend—momentum indicators paint a contradictory picture. The Average Directional Index (ADX) remains unusually low at just 13 on the four-hour chart, suggesting a lack of decisive directional conviction.

Technical Gauntlet

The current four-hour price action forms a symmetrical triangle pattern whose resolution will determine the price action before the deadline. Successfully breaking through the triangle’s resistance zone would signal a potential $109,000 breach, while containment within this consolidation structure would fail the market’s “Yes” resolution criteria.

The situation is further complicated by a divergence in the Squeeze momentum indicator across timeframes. While the four-hour chart shows a tightening phase, the one-hour chart indicates bullish impulse. This complexity, combined with a confluence of resistance levels including the psychological $109,000 mark and descending trendline support, explains why analysts view this as a coin-flip proposition.

Broader Risks on Horizon

Market participants face additional uncertainty beyond the immediate price target. The upcoming US holiday week creates a potential catalyst for exaggerated price moves, while fundamental risks—particularly regarding trade rhetoric and dollar strength—could destabilize investor positioning, increasing sensitivity to minor market moves.

The Countdown Continues

With the expiration moment approaching at 11:59pm UTC, the race against time enters its final stretch. Any sustained move above $109,000 before the deadline would transform today’s uncertainty into a narrative victory. Should Bitcoin remain below this pivotal level, analysts caution that this may simply represent the latest in a series of near-misses rather than an outright failure of the underlying upward trend.