Ethereum All-Time High: 63.6% Chance by Year-End, Technical Indicators Point Up

Ethereum Price has surged 58% in July, briefly touching $3,848, currently trading near $3,780.

Record Target: $4,891 (November 2021 peak)

Myriad users, on prediction markets platform Decrypt (parent company Dastan), are giving Ethereum a 63.6% probability of hitting a new all-time high above $4,891 by December 31, 2025.

The market has attracted significant volume, reflecting growing bullish sentiment. Analysis points to several technical indicators supporting the potential breakout, though a major resistance zone at the $4,000 level remains a formidable challenge.

Technical Indicators Suggest Strong Momentum

Significant bearish pressure was recently shaken off, as evidenced by a crucial technical formation:

- Golden Cross (Daily):

- Ascending Weekly Trendline:

The short-term moving average (50-day) crossed above the long-term average (200-day).

This is a widely recognized bullish signal typically indicating a sustained upward trend, last appearing in Ethereum’s chart last year.

The weekly chart shows an intact bullish channel since late 2022, suggesting medium-term strength.

While traditional metrics like the Relative Strength Index (RSI) sit at 69 (elevated but not overbought by historical ETH standards) and the Average Directional Index (ADX) nears 25 (confirming a strong trend), the overall chart picture fosters conviction among some analysts.

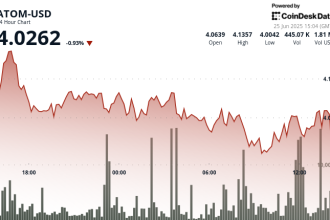

The $4,000 Barrier Endures

Despite the technical optimism, the $4,000 mark persists as a psychological and structural wall.

A dense resistance zone forms between $3,890 and $4,200, marked by a Volume Profile showing significant activity. History is littered with failed rallies from this region, reinforcing the idea that substantial volume and strong conviction will be necessary to breach it.

The upcoming deadline adds a temporal pressure, as the holiday period (New Year’s Eve falling on a Wednesday) may complicate sustained price action near resistance levels. Some market participants anticipate breaking records before December 31, while others view the deadline as a consequence, not a cause.

Betting the Odds: Prediction Markets Lean Bullish

Myriad, a prediction market backed by Decrypt, allows users to wager real money on the outcome.

The shift in market sentiment is stark: from bearish odds just a week ago (53% chance of missing the ATH) to the current 63.6% probability.

This bet relies partly on the possibility that the current bullish structure—breaking the ascending channel—could see previous resistance levels retested and ultimately transformed into support, potentially powering a move toward the $4,891 mark or even the pilot’s “$72,000 question” (approximately $5,200).

Pathway to the Target

Analysts suggest scenarios for reaching the ATH by year-end involve:

- Confirmation above $4,103 (weekly close): This critical level is a prerequisite.

- ADX crossing above 25: This would formally confirm the ongoing trend’s strength.

- Channel Support Holds above $3,100: Breaking below this mark would likely trigger a reassessment.

While the odds suggest a favorable risk-reward relationship for speculative wagers, opponents caution that the stubborn $4,000 resistance is not broken in 10 attempts since 2021. Two scenarios emerge:

Bullish Outcome Scenario

If the aforementioned technical factors align, Ethereum could reach $4,891 (new ATH) or the stretch goal $5,200 by year-end.

Bearish Containment Scenario

Alternatively, prices could consolidate, ending near $4,769—the highest plausible level without triggering a new ATH (though crossing the threshold earlier remains possible).

Key Levels Monitors

- $4,103 — Weekly momentum confirmation

- $3,100 — Survival level

- $4,891 — Current record high

- $5,200 — Stretch goal

Balanced Perspective

The chart structure presents compelling arguments for continued upside, supported by robust momentum signals and the execution of multi-month accumulation strategies.

However, the high hurdle of $4,000 remains unbroken territory, and predicting market movements remains inherently uncertain. A valuation debate seems secondary to these near-term dynamics in the current context.

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Trading and investing in crypto assets involve substantial risk and can result in significant losses.

Ethereum Weekly Chart Analysis:

[Image Placeholder: TradingView Ethereum Weekly Chart]

Ethereum Ascending Channel Pattern:

[Image Placeholder: TradingView Ethereum Ascending Channel Chart]