GameStop Raises $450M to Potentially Invest in Bitcoin

GameStop finalized a new $450 million convertible notes offering, bringing its total planned for this round to nearly $2.7 billion. The placement agent exercised its option to acquire an additional $450 million in 2030 notes.

Continuing Earlier Bitcoin Strategy

This funding round represents a significant expansion on GameStop’s stated investment policy, which explicitly mentions allocating capital to Bitcoin, as it did in May when it acquired $512 million worth of the cryptocurrency (valued at approximately $506 million today).

Background: GameStop announced its convertible notes offering in early 2024. The offering was previously increased to $2.25 billion and has now been finalized at nearly $2.7 billion following the greenshoe exercise.

CEO Cohen’s Declaration of Independence

Unlike its predecessor MicroStrategy (led by Michael Saylor), who pioneered the corporate Bitcoin treasury model, GameStop CEO Ryan Cohen has publicly stated the company is not following other strategic investors’ Bitcoin plans and will not pre-announce purchase schedules.

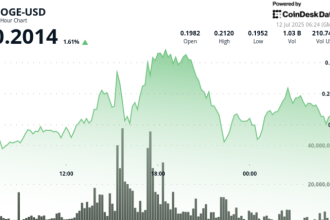

Market Reaction and Stock Performance

The company’s strategy of leveraging substantial debt financing for crypto investments has negatively impacted its stock price. Following its initial May purchase announcement and the recent $450 million raise, shares fell over 10% at one point and continue to trade below pre-meme stock rally levels.

Shares (GME) fell over 10% earlier this week upon announcing the latest financing. While the stock marginally closed higher on Wednesday, it reported a ~23% decline from the start of the year. This underperforms its performance during the 2021 meme stock phenomenon.

Beyond Crypto: NFT and Regulation

GameStop has previously explored non-traditional crypto applications outside of Bitcoin. Attempts to build utility included an Ethereum NFT marketplace and a separate NFT wallet initiative, both of which were abandoned within the past 12 months partly due to regulatory uncertainties.

Despite Cohen’s emphasis on independent decision-making, the scale of borrowing specifically earmarked for general corporate purposes—including potential Bitcoin additions—suggests continuity in the company’s broader diversification plans compared to its core retail video game business.