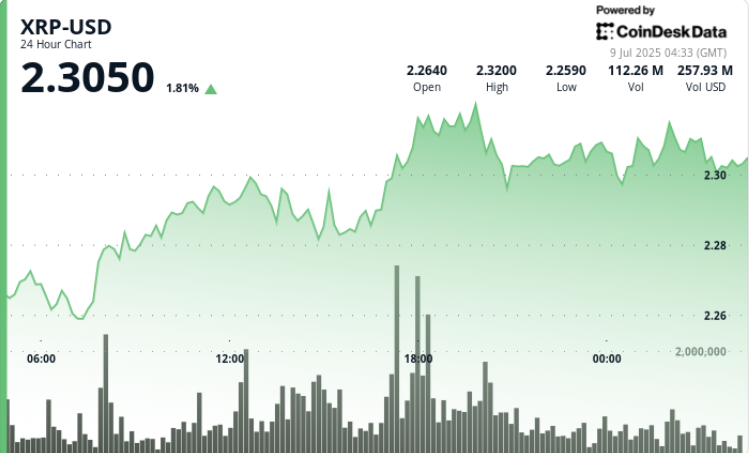

Ripple’s push for a U.S. banking license has reignited bullish momentum for XRP, fueling a high-volume breakout above the $2.28 resistance level and setting up a potential test of $2.38 — a level that, if breached, could trigger a larger upside move.

News Background

- Ripple’s application for a national trust bank charter with the U.S. Office of the Comptroller of the Currency

has provided a fundamental catalyst for XRP.

- The move signals deeper integration into the regulated financial system and is widely seen as a bullish step toward institutional adoption.

- As the regulatory narrative shifts, XRP has emerged as one of the few altcoins with both legal clarity and rising institutional interest.

Price Action Summary

- XRP rallied 2.36% over the 24-hour period from 6 July 03:00 to 7 July 02:00, climbing from $2.21 to $2.26 with high conviction buying.

- The breakout was defined by a surge in trading volume, peaking at over 67 million units during the 10:00 hour as price pushed through $2.28.

- Price action printed a daily high of $2.29, before pulling back and consolidating above support at $2.24–$2.25.

Technical Analysis

- The intraday range spanned $0.08 (3.62%), with key breakout points at 08:00, 10:00, and 13:00 — each confirmed by above-average volume.

- $2.24–$2.25 has established itself as strong support after bulls defended this zone during an 18:00 dip.

- The $2.28–$2.29 area now acts as immediate resistance. A decisive flip of this zone could open room for a run toward $2.38 — a level technical analysts are closely watching as the next major breakout trigger.

- In the final 60 minutes of the session (7 July 01:05–02:04), XRP surged from $2.26 to $2.27, a 2.29% jump, with momentum building at 01:30 and 02:01 — both marked by sharp volume spikes.

What Traders Are Watching

- A sustained close above $2.28 with volume confirmation could push XRP toward the next upside targets of $2.38, then $2.60–$3.40 in extension.

- Failure to hold $2.25 support would likely trigger a retest of $2.21–$2.22 demand zone.

- With a rising narrative around Ripple’s regulatory progress and XRP’s legal clarity, the asset remains one of the most structurally bullish large-cap tokens in the current macro environment.