XRP Faces Crucial $3 Resistance Test Ahead of New All-Time High Targets

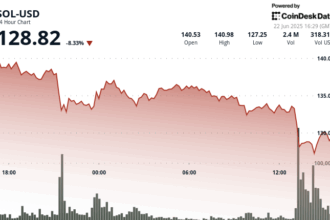

XRP (XRP) encountered significant selling pressure on Tuesday, declining 7.6% and hitting an intraday low of $2.80 from a five-month high approaching $3. Analysts warn that breaking through the $3 resistance level is critical for the digital currency to achieve further gains, potentially reaching new all-time highs.

$3 Resistance: Potential Looming for Deep Correction?

Following a 33% rally between July 8 and July 18, powered by recent institutional adoption and market sentiment shifts, XRP found immediate resistance just below $3. A failure to breach this critical threshold suggests bullish momentum is weakening.

Historical data highlights the significance of the $3 level. The last time the XRP/USD pair tested this barrier earlier this year resulted in a subsequent 46% decline, pushing the asset down to a multi-month low of $1.61 reached on April 7, 2024.

“Once $3.40 (ATH) breaks, it will likely shock people how quickly this runs. There’s not much in the way after that. Expect it to be incredibly fast and volatile!”

Cryptocurrency analyst CasiTrades offered commentary following Tuesday’s price action. The analyst highlighted the strategic importance of clearing the $3 barrier, suggesting a successful breakout combined with retesting could establish the level as support.

CasiTrades linked the $3 break to a broader market pattern, referencing a 0.118 Fibonacci retracement from the higher $3.40 area. Reclaiming this subsequent resistance, if consolidated after a $3 breakthrough, could signal the continuation of a multi-wave bullish cycle, often referred to as Wave 3 in market analysis, potentially accelerating towards new all-time highs at $3.40.

XRP Liquidation Heatmap: Near-Term Resistance Around $3.04-$3.14

Data from Binance’s XRP/USDT liquidation heatmap indicates concentrated selling pressure around key price points, potentially defining near-term resistance dynamics.

A notable cluster of liquidation activity is visible above $3.04, suggesting heightened short positions clustered at these levels. If price action merely touches or approaches this $3.04 resistance zone without breaking through, large-scale liquidation selling could be triggered, potentially forcing buyers to cover positions and lifting the price.

However, analysts are cautiously optimistic about further upside potential despite the elevated liquidation risk. XRP’s derivatives market continues to show signs of conviction, with aggregate open interest (OI) in XRP futures reaching nearly $8.11 billion. This represents a substantial 121% increase since June 23, though still slightly below the peak of $8.33 billion observed on January 19 earlier in the year.