Escalating Middle East Tensions Spark Crypto Market Selloff

War of nerves between Israel and Iran has triggered a sharp fall in cryptocurrency prices, contributing to widespread investor unease in capital markets.

Immediate Impact

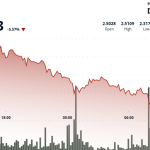

Since the conflict began on June 13th, Bitcoin has fallen approximately 3%, from recent highs to about $105,000. Simultaneously, Ethereum prices plunged 8%, dropping near the $2,500 mark. This six-day period saw the aggregate crypto market cap erase nearly $200 billion.

The Trigger: Rhetoric of Intervention

The downturn appears linked to increased geopolitical tension, particularly heightened by US President Donald Trump’s warnings regarding potential US military intervention. Last week, Israel retaliated against Iran-backed militants by conducting airstrikes.

Trump’s comments on social media, where he allegedly stated, “We know exactly where the so-called ‘Supreme Leader’ is hiding… Our patience is wearing thin,” referring to Iranian leader Ayatollah Khamenei, added to the volatility.

Wider Market Effects

The uncertainty surrounding a potential wider conflict sent tremors across global markets. While US equities slipped, oil prices climbed due to fears of disrupted supply, and gold prices fell – typically a safe haven asset during crises.

Risk assets, including stocks and cryptocurrencies, often experience initial declines during escalating geopolitical crises as investors prioritize safety.

Supply Chain Disruptions and Inflation Concerns

Armed conflict carries the potential to disrupt global supply chains, destabilize economies, and cause inflation, particularly concerning energy prices. Iran is a significant global oil producer.

Crypto Market Specifics

The impact of Trump’s interventionist rhetoric was notably severe for the cryptocurrency sector. Shares in Coinbase fell 4%, Block (Strategy) dropped about 3%, and Circle plunged nearly 3%, despite its recent successful IPO offering substantial returns to early investors. These losses have partially recovered since.

Odds of Escalation Increase

Market participants assessed the likelihood of a US military strike on Iran before August, rising to 70% on prediction platform Polymarket.

Unpredictable Longer-Term Outlook

The longer-term impact of a potential wider Middle East conflict on Bitcoin remains unclear. While geopolitics significantly influences prices, cryptocurrency markets demonstrate a history of resilience.

In 2022, following Russia’s invasion of Ukraine, Bitcoin underperformed gold. However, after the Hamas attacks against Israel in 2023, gold and Bitcoin both experienced significant rallies, with Bitcoin gaining the most.

“There might be more at play than just rising relations tensions in the Middle East,” noted Bitcoin analyst James Halloran, suggesting factors like previous market conditions (e.g., Fed rate hikes and bear markets) or the introduction of new financial products (Bitcoin ETFs) could shape outcomes.