Aster DEX Sees Record-Breaking Trading Volume

Recent data from analytics provider DefiLlama reveals a significant surge in trading activity on Aster, a decentralized exchange (DEX) specializing in on-chain perpetual contracts.

The platform recorded a monthly trading volume exceeding $33 billion in June, establishing a new all-time high and marking a threefold increase compared to the previous peak volume recorded a year earlier.

Intensifying Competition

While rival DEX Hyperliquid reported nearly $86 billion in June volume, placing Aster’s achievement into context, Aster’s rapid growth highlights the intensifying competition within the sector.

Dark Pools and Hidden Orders

The heightened trading activity occurs as Aster introduces “hidden orders,” a feature designed to protect traders from front-running and market manipulation by obscuring large orders from the network until execution.

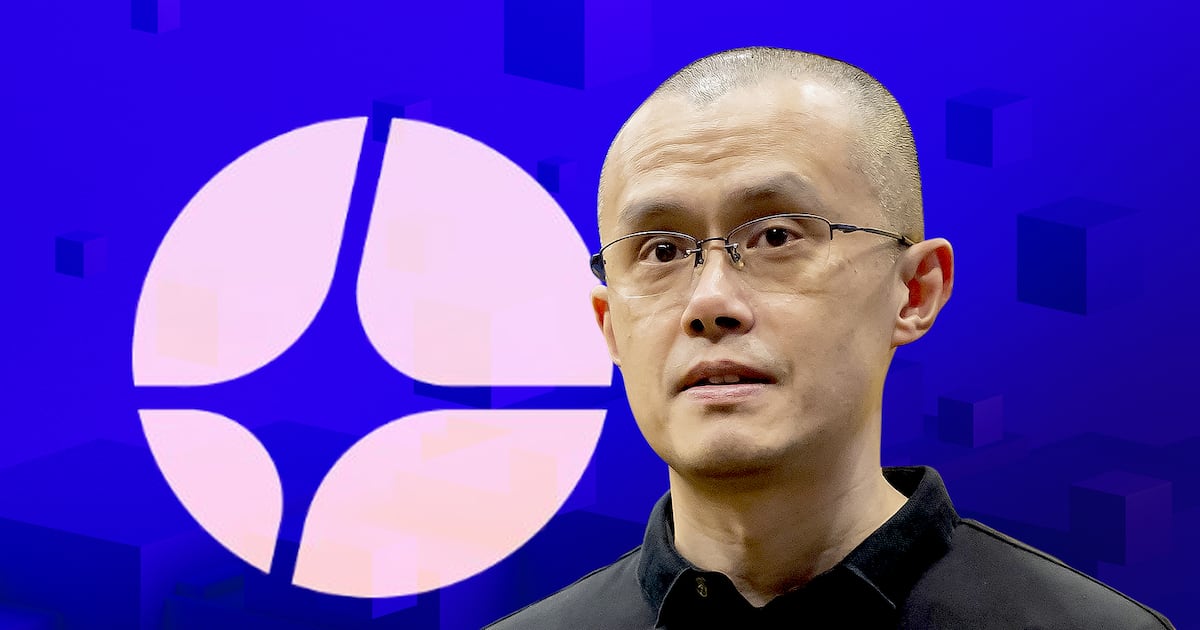

This development is particularly noteworthy following remarks from Binance founder Changpeng Zhao (CZ), who publicly advocated for DEXs, including Aster, to implement dark pools.

“If you’re looking to purchase $1 billion worth of a coin, you generally wouldn’t want others to notice your order until it’s completed. Otherwise, people might try to buy before you, effectively front-running you. In the case of a DEX, this can lead to MEV attacks. This results in increased slippage, worse prices, and higher costs for you.”

— CZ

Aster describes its hidden order feature as a mechanism to create a confidential “shadowy trade zone” where users can transact without broadcasting their positions publicly.

Traders cite a key advantage: unlike large, visible orders like James Wynn’s $100 million Bitcoin position in May, hidden orders prevent users from inadvertently moving the market against themselves by attracting liquidation hunters.

Hidden order functionality is not new to traditional finance, where institutional investors utilize private, off-book matching. However, implementing dark pools on public blockchains is more complex, often requiring advanced cryptographic tools like zero-knowledge proofs to conceal transaction details until completion.

Despite Surge, Competition Looms Large

Despite the significant volume increase, Aster remains overshadowed by Hyperliquid in terms of market share. Hyperliquid commanded approximately $186 billion in June volume, accounting for nearly 62% of all perpetual DEX trading volume over the past 30 days.

A further point of differentiation is that Aster has yet to launch its native token, whereas Hyperliquid has. While Aster employs a points program potentially leading to a future token airdrop, its immediate focus is operational expansion.

Crypto Market Context

The surge in activity on platforms like Aster takes place within a broader cryptocurrency market context:

- Ethereum prices rose by roughly 0.8% during the relevant period, trading around $2,427.

- Cryptocurrency markets showed signs of resilience following the Iran-Israel ceasefire deal.

- Monetary moves by the Russian Central Bank have impacted cryptocurrency usage within specific regions.

- Ethereum’s proposed upgrade EIP-7782 could potentially reduce network latency.

- Dogecoin experienced a notable price jump following a marketing campaign on Solana.