Ethereum Rally Ignites “ETH Season” Hopes

Ethereum (ETH) has surged past the $3,200 threshold, fueled by a 30% price increase over the past two weeks. Traders are increasingly bullish, signaling the arrival of “Ethereum season.”

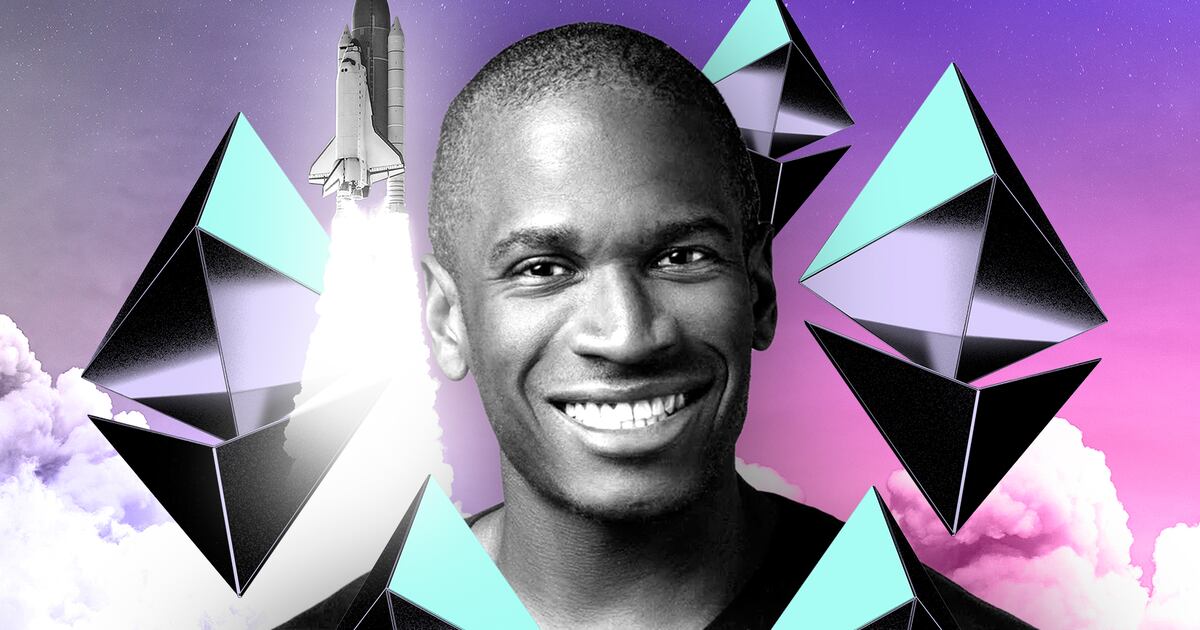

“It’s [Ethereum season],” Arthur Hayes, a prominent crypto investor and influencer, stated on X.

“What are we buying? The best in class for every DeFi vertical. Some charts are better than others, but they will all rip if Ether continues outperforming.”

Options data further reinforces the positive sentiment. According to Deribit, Ethereum options with a high open interest are priced significantly above current levels. The highest volume for expiring August 30 options cluster at the $4,000 strike. Bullishness intensifies with increasing open interest around September $4,400 expiries and December options approaching $5,000.

Several factors contribute to the optimism:

Legislative Developments

The ongoing consideration of cryptocurrency bills in Washington DC is viewed by many as potential catalysts for stability and growth within the industry. Increased focus suggests lawmakers may establish clearer regulatory frameworks soon.

However, recent events saw a temporary setback. On Tuesday, Republican lawmakers delayed a landmark stablecoin bill. President Donald Trump subsequently urged lawmakers to expedite the passage of the “Genius Act,” alongside stablecoin-related activity, as noted industry figures observe.

Capital Rotation and Stablecoin Demand

All eyes remain on Bitcoin, which trades near its all-time highs. Capital rotation from Bitcoin is a factor traders watch, anticipating that weaker altcoins like Ethereum could benefit.

“That’s exactly what I’m waiting for,” stated Lukas Enzersdorfer-Konrad, deputy CEO of crypto exchange Bitpanda.

Furthermore, stablecoin usage, particularly increases in Circle’s USDC and Tether’s USDT, is seen increasing demand for Ethereum at an infrastructure level, according to Wall Street strategist Tom Lee. This outlook points to further upside potential for ETH.

Consolidated Narratives

” narratives surrounding Ethereum are finally aligning,” analysts note.

The convergence of regulatory pending matters, potential capital flow from Bitcoin, and increasing stablecoin activity all point towards Ethereum being central to the current crypto market conversation.

If the current bullish momentum persists, questions among traders may soon shift from “What to buy?” to “How high can ETH go?”

Ethereum has gained 8.1% over the same period, currently trading at $3,234.