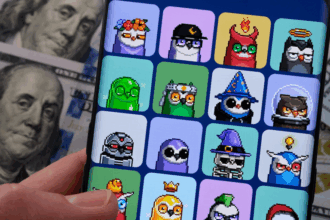

Solana co-founder Anatoly Yakovenko has ignited controversy following his labeling of memecoins and non-fungible tokens (NFTs) as “digital slop,” despite substantial memecoin-derived revenue being central to Solana’s operations.

The “Digital Slop” Comment

In a post on X, Yakovenko defended his long-standing view:

“I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value.”

The remarks, made during a debate with Base creator Jesse Pollak, saw Yakovenko compare these assets to loot boxes in mobile games.

The Debate: Market vs Intrinsic Value

The discussion pivoted on whether memecoins/NFTs possess fundamental value. Yakovenko asserted their worth stems from “market-driven price discovery,” while Pollak argued for inherent value inherent in the content, analogizing it to the artistic value of a painting:

“The content itself is valuable. just like a painting is fundamentally valuable, regardless of whether you charge people at the museum to see it.”

Analogy to Apple’s Loot Boxes

Juxtaposing his low view of memecoins with the platform’s success, Yakovenko suggested Apple’s revenues would similarly plummet without loot boxes. Loot boxes are virtual in-app item containers in free-to-play mobile games hosted on Apple’s App Store. Their use in gaming faces criticism and regulatory scrutiny for potentially fostering addictive spending behaviors.

Context and Precedent

Yakovenko’s skepticism towards memecoins and NFTs is not new. Earlier X posts, dating back to at least January 2024, reflect his long-standing perspective.

Crypto Community Pushback

The latest comments drew sharp criticism, with figures like crypto commentator Karbon suggesting Yakovenko’s stance was “more distasteful,” particularly contrasting it with Vitalik Buterin’s views while noting the irony of bashing assets contributing significantly to Solana’s revenue.

Solana’s Heavy Reliance on Memecoins

Data highlights the very basis of Yakovenko’s critique:

- According to Syndica, memecoins accounted for 62% of Solana’s network DApp revenue in June, reaching an all-time high.

- This activity drives a large portion of Solana’s overall revenue, estimated at $1.6 billion during the first half of 2025.

- Much of this revenue originates from Solana-based memecoin platforms.

Consistent but Competing Offerings

While Solana’s memecoin infrastructure remains dominant (“Pump.fun” and “PumpSwap”), a rival network (“LetBonk”) has emerged as a growing competitor for leading revenue positions on the ecosystem.