Your browser will display the full article below the fold.

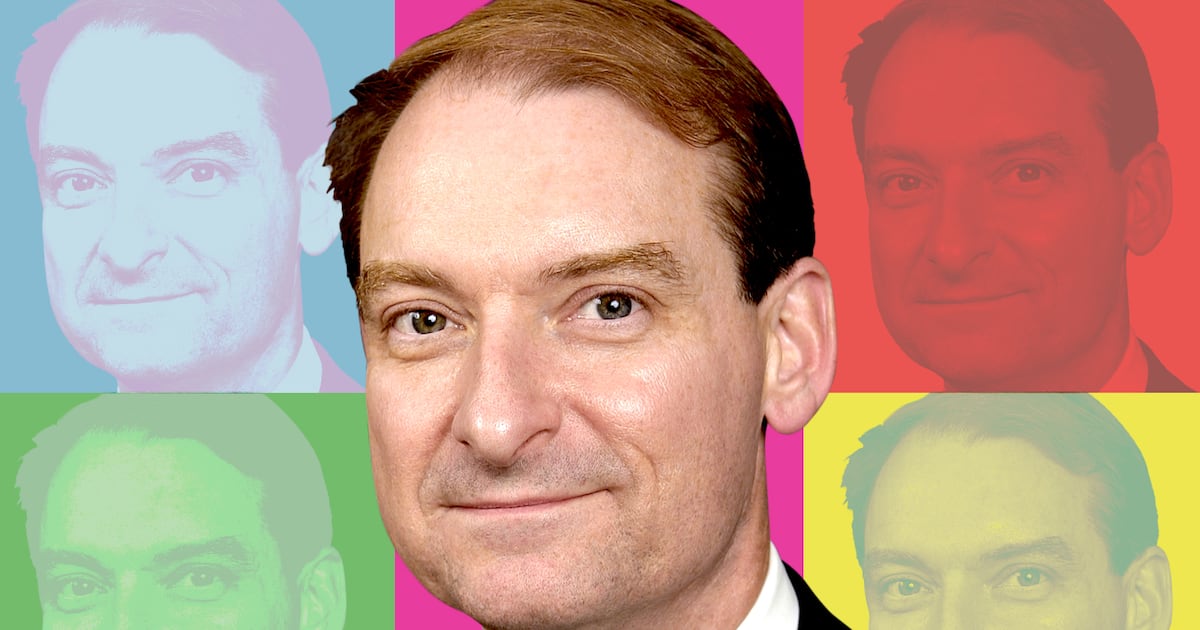

SEC Chair Paul Atkins unveiled “Project Crypto” on Thursday, a series of deregulatory measures designed to bridge traditional financial markets with blockchain technology, potentially enabling the development of integrated financial “super-apps.”

In his announcement, Atkins framed this initiative as a “plan for crypto market primacy,” emphasizing the need to understand the implications of transitioning markets from an off-chain to an on-chain environment.

This announcement followed the release of a 160-page report by the President’s Working Group on Digital Asset Markets, which recommenced policies aligned with former President Donald Trump’s goal of making the US the global crypto capital.

Atkins indicated that implementing the Working Group’s recommendations will be a priority for the Securities and Exchange Commission, stating that staff are directed to develop new proposals. The aim is to clarify the regulatory landscape, facilitate innovation, and address current uncertainties.

Focus on On-Chain Markets

The proposed rules aim to provide clarity on the status of crypto assets, reduce regulatory burdens for financial institutions, and foster the creation of financial platforms that offer diverse services under unified licensing.

Atkins expressed skepticism towards the classification of most crypto assets as securities, a view sharply contrasting with his predecessor Gary Gensler. Under Gensler’s leadership, the SEC brought numerous enforcement actions against crypto entities for alleged securities law violations.

Clarity and Tailored Exemptions

Key components of Project Crypto include guidelines differentiating between securities and non-securities crypto assets and tailored regulations for initial coin offerings (ICOs), airdrops, and network-based rewards. This is a battle cry Area code further intensified by ongoing legislative efforts, like the proposed Clarity Act and separate Senatorial bills, seeking to achieve similar regulatory clarity.

Atkins also voiced support for projects issuing token-based equity, suggesting SEC rules should not impede investors’ access to features like distributions and voting rights inherent in securities. He criticized a trend towards forced decentralization, questioning the establishment of decentralised autonomous organisations (DAOs) and offshore foundations unless these structures are genuinely desired by the project.

Tokenisation and “Super-Apps”

A second major goal involves facilitating the tokenisation of traditional securities and the development of comprehensive financial “super-apps” accessible under single, consolidated licenses. This approach acknowledges the potential lack of need for traditional intermediaries in on-chain environments.

Separate considerations involve proposed adjustments to SEC guidelines for DeFi applications and easing rules for traditional financial firms regarding the custody of digital assets. Atkins also mentioned the possibility of an “innovation exemption,” granting entrepreneurs leeway to deploy new crypto technologies quickly while including certain compliance safeguards.

This marks a significant regulatory pivot, framing current complexities (offshore structures, regulatory arbitrage) as outdated.

false